- Td (Tetanus/Diphtheria, if injury- will need urgent care visit) $52 TdaP (Tetanus/Diphtheria/Pertussis-whooping cough, if injury- will need urgent care visit) $79 TB Test (PPD/Tuberculosis Screening) $37.

- Urgent Care Costs Medicare Part B (Medical Insurance) helps cover the cost of urgently needed care that is not a medical emergency. You will pay 20% of the cost for services, and the Part B deductible will apply. In the event that you visit an outpatient urgent care clinic in a hospital, you may also be charged a copayment by the hospital.

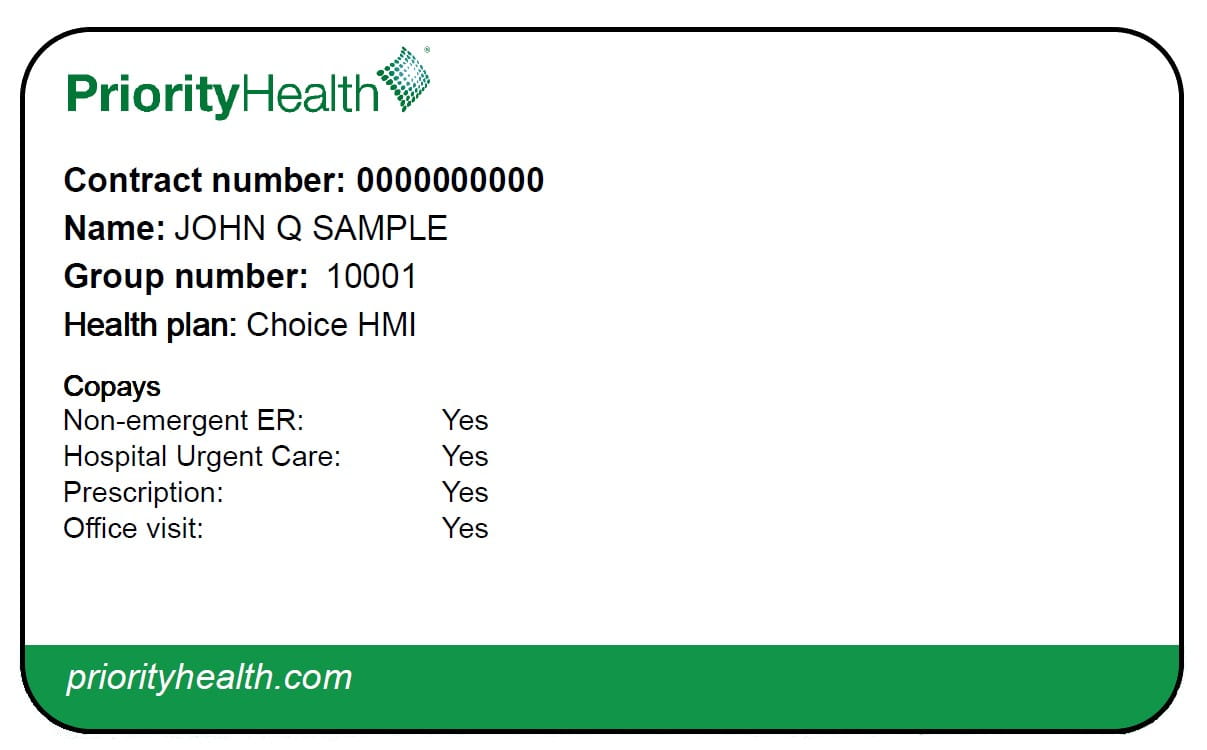

- $0 Copay: $0 Copay. $0 Copay: Urgent Care. $0 Copay: 20% Coinsurance. Emergency Care: $0 Copay. 20% Coinsurance: Worldwide Emergency Coverage (Up to $10,000 of coverage every year) $0 Copay. $0 Copay: Ambulance Services. $0 Copay: 20% Coinsurance.

- Medicare (Part B) typically covers most urgent care situations

- There are some out-of-pocket costs that you may have to pay, however.

- While Medicare Part B covers urgent care and emergency room care, urgent care is typically cheaper and has a shorter waiting time.

Pays 100%, after $250 Copay. Urgent Care Coverage is available for all of the employee's eligible children age 6 months to age. NORTH CAROLINA – Medicaid. Benefits Enrollment Guide April 1, 2015 – March 31, 2016. Apr 1, 2015 Lower Copay for Urgent Care(Current Plan – $75/New Plan $60) increase in salary. Institutional Care (inpatient hospital care, rehab care, etc.) $75: 10% of the cost the agency pays for the entire state: 20% of cost the agency pays for the entire state: Non-Institutional Care (physician visits, physical therapy, etc.) $4.00: 10% of costs the agency pays: 20% of costs the agency pays: Non-emergency use of the ER: $8.00: $8.00: No limit.

Learn more about the qualifications for Medicare urgent care coverage and how to get help covering some of the additional costs.

Medicare Urgent Care Coverage

Urgent care typically falls under the Medicare coverage category of emergency department services. Medicare Part B covers all emergency department services within the U.S., which includes any service or care provided when you have an injury, sudden illness or condition that worsens very quickly.

Urgent Care Locations vs. Emergency Room Care

Both urgent and emergency room care are covered by Medicare Part B as outpatient care. However, there are several advantages to receiving care at an urgent care center rather than a hospital ER. A visit to the urgent care clinic can often mean:

- Lower costs

- Shorter wait time

Urgent care centers are typically staffed by physicians, physician's assistants and nurses, just like any other doctor's office or ER — the difference is that they aren't equipped to treat life-threatening injuries or illnesses. As long as your injury or illness is non life-threatening, a visit to the urgent care clinic may save you money and time.

Medicare Part A does not cover urgent care clinic visits, but it will help cover some of the costs of inpatient hospital care, lab tests, surgeries and some other costs.

How Does Medicare Pay for Urgent Care Location Visits?

As long as the urgent care center you go to participates in Medicare, your Medicare insurance will typically cover 80 percent of theMedicare-approved cost for services, and you'll pay the remaining 20 percentcoinsurance after you have met your Medicare Part B deductible (which is $203 per year in 2021).

Medicare Advantage and Urgent Care Coverage

Another way to receive Medicare coverage for urgent care is through a Medicare Advantage (Medicare Part C) plan. These plans are sold by private insurers and are required by law to provide all of the same basic benefits as Medicare Part A and Part B.

However, just because an urgent care center accepts Medicare doesn’t mean they will accept all Medicare Advantage plans. Much like more traditional health insurance plans, many Medicare Advantage plans feature networks of doctors, hospitals, pharmacies, medical equipment providers and other types of health care providers including urgent care locations.

Before visiting an urgent care location, check to see that the facility is included in your Medicare Advantage plan network. If they are not a network participant, the visit is not likely to be covered and you may be left responsible paying out of pocket for your care.

While the Medicare Part B deductible and coinsurance amounts are standardized, the costs associated with Medicare Advantage can differ from one particular plan to another. So the cost of your urgent care visit will depend on the terms of your specific plan.

Medicare Supplement and Urgent Care Coverage

Some of the costs of an urgent care visit that's covered by Medicare can be paid for by a Medicare Supplement Insurance (or Medigap) plan. Medigap plans are sold by private insurance companies and provide coverage for Original Medicare deductibles, copayments, coinsurance and other out-of-pocket requirements.

Each type of Medigap plan provides at least some coverage for Part B coinsurance, and eight of the 10 Medigap plans available that are available in most states cover Part B coinsurance costs in full.

Some Medigap plans can also pay for Part B excess charges, which may result when visiting an urgent care clinic that accepts Medicare patients but does not accept the Medicare-approved amount as full payment. These providers are allowed to charge up to 15% more than the Medicare-approved amount.

Medicaid Urgent Care Copay Insurance

Medicare Supplement Insurance can help cover your out-of-pocket urgent care costs.

Find a planResource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

Medicaid Urgent Care Copay Coverage

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?